G20: Caritas Internationalis calls for private lenders to share in ‘debt cancellation’

In a letter released by the Catholic charity, 124 faith leaders call on the finance ministers of the richest countries in the world to take concrete steps to end the scandal of poor countries spending more on debt repayment than on health and education. The goal is to set up a UN Debt Convention and a public global debt registry.

Johannesburg (AsiaNews) – About 124 religious leaders, from the Catholic Church and other religious groups, signed a letter addressed to the G20 finance ministers, meeting today and tomorrow in Johannesburg for their annual summit.

“As faith leaders, we are deeply troubled at the impact this current debt crisis is having on the lives of the poorest and most vulnerable across the world,” reads the letter. “Today, the need for action is even greater than the last Jubilee in 2000, when the first campaign for debt relief was launched: 3.3 billion people – nearly half the global population – now live in countries that spend more on debt payments than on health, education, or life-saving climate measures.

Caritas Internationalis is promoting the initiative following Pope Francis’s appeal to this effect on the occasion of the 2025 Jubilee.

The first signature on the letter belongs to Cardinal Stephen Brislin, Archbishop of Johannesburg, who chairs the Catholic Bishops' Conference of South Africa, the country that holds the rotating presidency of the G20 this year.

The list of signatories include Cardinal Tarcisio Isao Kikuchi, Archbishop of Tokyo, who heads Caritas Internationalis, and many other cardinals, bishops, superiors of religious institutes, and representatives of other Christian confessions.

This is not a general appeal, but a letter that takes into consideration some technical aspects of the issue of poor countries’ debt.

The most important one is the profound transformation that has taken place in recent years, with the massive entry into the international credit system of subjects that are not individual states or multilateral bodies, but private institutions often with speculative purposes.

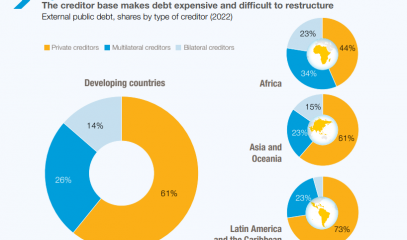

A recent report by UNCTAD, the UN agency for trade and development, found that 61 per cent of the debt of poor countries is held by banks or investors who buy particular financial instruments on the markets (see Unctad graph in picture 2).

This makes it harder to negotiate fairer conditions for those states that are unable to meet their financial commitments with much higher interest rates than those on loans granted to economically more advanced countries.

“Debt restructurings under the [Common] framework (adopted by the G20 in 2020 during the pandemic) take three times longer than previous processes, while private creditors – now the largest creditor group globally – are able to delay negotiations and demand higher repayments than debtor countries can afford.”

These financial mechanisms force millions of people “to endure hunger, lack of access to essential services, crumbling infrastructure and the worst impacts of the climate crisis.”

Starting from this, the letter calls on the finance ministers of the richest countries in the world to adopt four very concrete measures:

1) “Champion a debt cancellation framework that brings debt payments down to a genuinely affordable level,” going beyond the now outdated Common Framework plan and suspending debt payments while cancellation is being negotiated.

2) “Pass legislation in key jurisdictions to ensure private lenders participate in debt cancellation and suspend payments to private lenders during negotiations.”

3) “Reform International Financial Institutions, ensuring that debtor countries are properly represented and that debt sustainability assessments and policy conditions centre human and environmental rights.”

4) “Support the creation of a UN Debt Convention to agree rules on resolving/settling debt crises, responsible lending and borrowing and the establishment of a public global debt registry so that all lenders and borrowing governments are held accountable.”

The letter ends, saying: “Taking these steps will not only address the immediate debt crisis but also lay the foundation for a more just and resilient global financial system. As faith leaders, we urge you to be Pilgrims of Hope acting with courage, solidarity and compassion in this Jubilee year.”

.png)